When OnPay exports pay run data to QuickBooks, you may choose how the data is formatted:

- In Summary

- In Detail

In Summary

This option streamlines the transaction so only two journal entries from OnPay are sent to QuickBooks.

- Payroll - All wages, deductions, and taxes withheld for all employees

- Tax Sweep - All employee and employer taxes that OnPay debits from your bank account

You can:

- Map your payroll wages by pay type or by department

- Use QuickBooks Classes or Locations

You cannot:

- View employee salary information in QuickBooks

"In Summary" journal entry examples

Here’s what a summary transaction looks like in QuickBooks.

Journal Entry (Payroll)

Note that the memo field includes only the pay run ID and check dates.

Journal Entry (Tax Sweep)

In Detail

Selecting "In Detail" means OnPay will send:

- Separate journal entries for each employee

- The Tax Sweep

- The Direct Deposit Sweep

This makes it easy to:

- Reconcile the Tax Sweep and Direct Deposit Sweep with the debits OnPay makes to your bank account

- See any uncashed employee paychecks and reconcile them with your bank feed

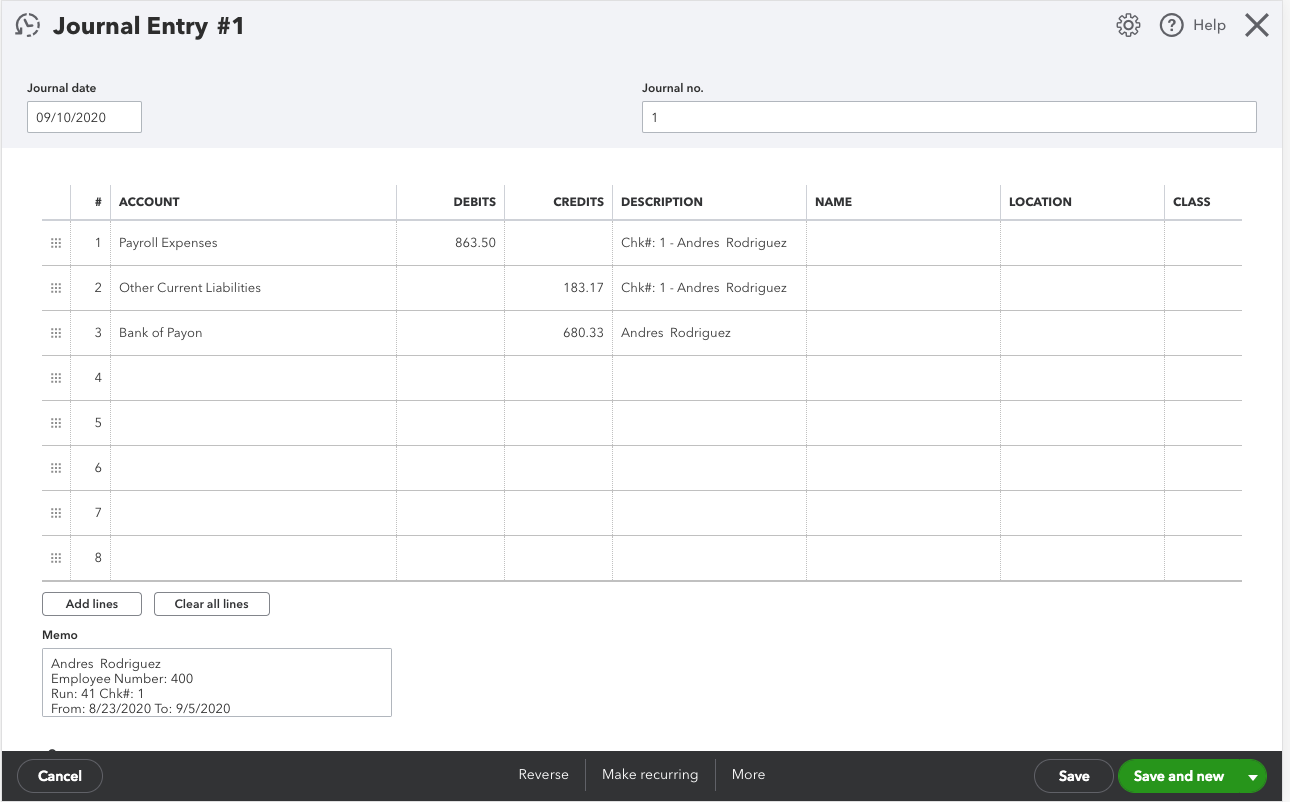

"In Detail" journal entry examples

Here’s what detailed transactions look like in QuickBooks.

Journal Entry (Payroll)

The memo field includes the employee name and number, as well as the run ID and check dates.