If you have already run payroll, and realize there was a mistake, you can remove and delete that pay run as long as no bank drafts have taken place. OnPay typically drafts payroll taxes and direct deposit funds the day before your check date. Once payroll is run on the check date, OnPay will draft the funds on the next business day.

Note: If you need to stop a pay run and you don't see the Delete button, then you will need to contact our Client Experience team at 877-328-6505.

Reasons for removing a pay run:

- An employee was paid too much or too little.

- An employee was included on the payroll that did not need to be paid.

- Incorrect hours or earnings types were entered. (i.e. vacation, sick, bonus, etc.)

- The incorrect taxes were withheld because of a mistake with the employee setup.

Removing the pay run

From the Dashboard, scroll down to "Recent Runs". Click the "Expand" box (or "View All"). To remove a pay run, click its Delete button.

Note: Removing pay runs removes all data associated with that run. You will need to rerun the payroll, including all employees that are supposed to be paid for that check date.

Don't see a Delete button?

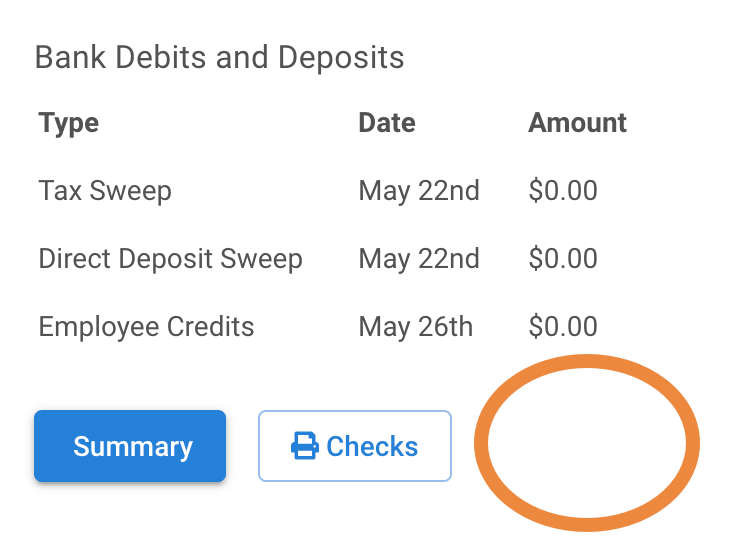

The Delete button does not appear if the payroll tax and direct deposit drafts have already occurred for the pay run. If you still need to stop the run, contact our Client Experience team at 877-328-6505.

What happens if payroll drafts or tax payments have already occurred

If the payroll tax and direct deposit drafts have already occurred, you will need to call OnPay Customer Service at 877-328-6505. If the employees have received the funds, OnPay cannot reverse the transaction from their account. The employer will have to collect those funds from the employee. If the taxes have already been paid to the state or federal agency, OnPay cannot refund the money until you run another payroll with taxes that meet or exceed the overpaid funds. If your company does not have any other payrolls in the quarter or if your company does not run enough payrolls in the rest of the quarter to cover the overpayment, the overpayment will be refunded by the IRS or the state. If you have any additional questions please let us know by calling 877-328-6505 Monday-Friday 9AM-8PM ET.

v6.0 ps